If you’re inviting a 2nd kid, your costs and savings routines may need a tune-up.

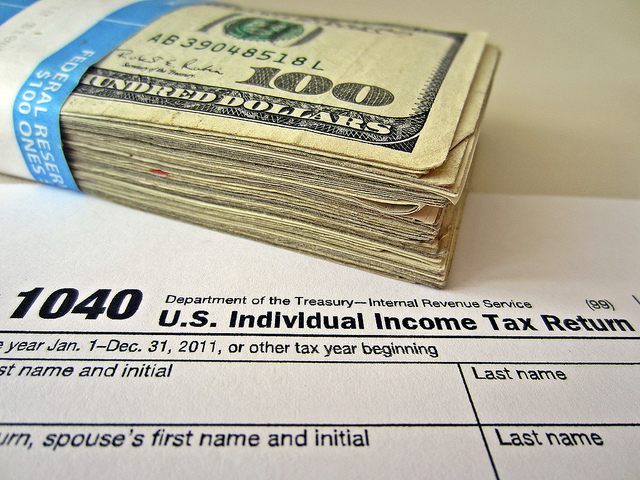

Having kids is anything however inexpensive. According to the USDA, families can anticipate spending approximately $233,610 raising a child born in 2015 through age 17– which’s not including the cost of college. The expense of raising a child has likewise increased because your parents were budgeting for kids. Between 2000 and 2010, for example, the expense of having kids increased by 40 percent.

If you have actually had your very first child, you comprehend– from diapers to daycare to future extracurricular activities, you understand how everything builds up. You’ve currently learned how to change your budget for child number one. How hard can it be duplicating the process a 2nd time?

While you may seem like a parenting pro, overlooking pointers to prepare economically for a second child could be bad news for your checking account. Luckily, affording a second child is more than manageable with the ideal planning.

If your household is about to broaden, think about these budgeting suggestions for a second kid:

1. Hesitate about upsizing

When asking yourself, “Can I pay to have a second kid?”, consider whether your present home and vehicle can accommodate your growing family.

Kimberly Palmer, the personal financing professional at NerdWallet, says sharing bedrooms can be a significant money-saver if you’re considering suggestions to prepare financially for a second child. Sharing may not be a choice, nevertheless, if a second child would make a currently small area feel much more confined. Running the numbers through a mortgage affordability calculator can provide you an idea of how much a larger house might cost.

Swapping your current automobile out for something bigger might also be on your mind if taking a trip with kids indicates doubling up on vehicle seats and stowing a stroller and diaper bag onboard. However, updating could indicate adding an expensive car and truck payment into your budget plan.

“Parents ought to first choose how much they can afford to invest in a vehicle,” Palmer states.

Buying used can help stretch your budget when you’re attempting to manage a 2nd child– however, do not cut corners on cost if it suggests sacrificing the safety features you want.

Households can expect to spend an average of $233,610 raising a child born in 2015 through age 17– and that’s not including the cost of college.

2. Economize about child equipment

It’s appealing to head out and purchase all-new products for a second baby, however, you might wish to withstand the desire. Palmer’s suggestions to prepare financially for a second kid consist of reusing as much as you can from your first child. That might include clothing, furnishings, blankets, and toys.

Being prudent with household expenditures can even extend past your own closet.

“If you live in an area with many children, you’ll typically find other families handing out carefully utilized products for complimentary,” Palmer states. You may likewise wish to scope out consignment shops and thrift stores for child items, in addition to online marketplaces and neighborhood online forums. However similar to purchasing a utilized automobile, keep security first when you’re utilizing this budgeting suggestion for a second kid.

“It is necessary to look for remembers on products like strollers and cribs,” Palmer says. “You also wish to make certain you have a current safety seat that hasn’t remained in any car crashes.”

3. Weigh your child care choices

You may currently understand how expensive daycare can be for simply one child, however that doesn’t imply affording a second kid will be difficult.

Michael Gerstman, chartered financial specialist and CEO of Gerstman Financial Group, LLC in Fort Lauderdale, Florida, states moms and dads must think of the trade-off in between both moms and dads working if it suggests paying more for day care. If one parent’s earnings is going exclusively toward childcare, for example, it might make more sense for that parent to remain at house.

Even if this budgeting suggestion for a second child is appealing, you’ll likewise want to consider whether taking some time away from work to care for kids could make it tough to get ahead later on in your career, Palmer includes.

“If you stay at home with your child, then you’re also possibly sacrificing future incomes,” she states.

4. Look out for sneaky expenditures

There are two major budgeting tips for a 2nd child that can sometimes be overlooked: review grocery and energy expenses.

If you’re purchasing formula or other grocery products for a newborn, that can rapidly add to your grocery budget plan. That grocery budget plan may continue to grow as your second kid does and transitions to solid food. Having a new child might also indicate larger energy expenses if you’re doing laundry more frequently or running more cooling or heat to accommodate your household investing more time inside your home with the little one.

Gerstman advises utilizing a budgeting app as a suggestion to prepare financially for a second child because it can assist you strategy and track your costs. If possible, begin tracking expenses prior to the child shows up. You can anticipate how these might alter as soon as you welcome home infant second, especially considering that you have actually already seen how your costs increased with your first child. Then, compare that estimate to what you’re in fact investing after the infant is born to see what might be costing you more (or less) than you thought every month. You can then begin remodeling your budget plan to reflect your brand-new reality and help you afford a second child.

5. Focus on financial objectives in your new budget plan

The majority of tips to prepare economically for a 2nd kid concentrate on costs, however, don’t neglect to produce line products for conserving in your budget plan.

Settling debt and saving for retirement ought to likewise be on your radar. You may even be thinking about beginning to save for your kids’ college.

Try your best to keep your own future in mind along with your kids. While it feels natural to put your kids’ needs first, keep in mind that your requirements are also your family’s and looking after your future means taking care of theirs, too.

Comments