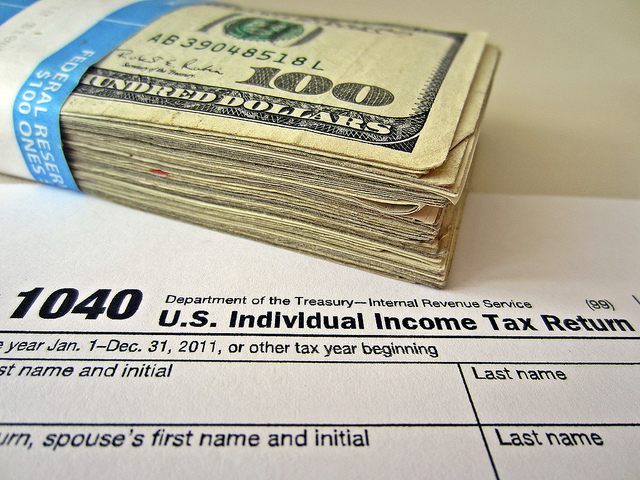

With the tax due date upon us, Tax Refund Windfall Syndrome is back in complete force! While this year’s typical tax refund is down a little compared to last year, it is still in the $2,800+ range.

You won’t be getting a pat on the back from me for receiving a tax refund. Tax refunds, after all, are interest-free loans to the U.S. government that normally can be credited to taxpayers being too conservative with their withholding tax allowances.

If you have received (or will be) a sizable refund, the bright side is that you have actually successfully made it through the previous year without that additional capital, so now you can put those regained funds to excellent use. Keep in mind, a refund is not a gift from the IRS, it’s not a windfall to be utilized on (lack of) discretionary costs, it is your difficult made money, and it has actually fallen behind on being used to your financial improvement. In my viewpoint, here are the 4 finest ways to make up for your money’s wasted time.

1. If you Get 401K or HSA Company Matching, Bump your Contributions by the Quantity of your Refund

If your company uses you a 401K match on your employee contributions, and you aren’t already pacing to get that optimum match, you’ll make a really high return on topping off your 401K by the quantity of your refund.

The exact same chooses any matching HSA funds you may get. Where should you contribute? To whichever of the two gives you the highest matching return. If you were currently arranged to make the most of one of them, then move on to the next one.

Considered that you can’t straight contribute to your employer-sponsored 401K or get coordinating HSA funds outside of payroll, in theory, the process would work like this:

- Include the quantity of the tax refund to your bank account.

- Elect to bump up your 401K or HSA contributions by the amount of your refund over the next few pay periods, increasing your contributions and company matching funds.

- Usage the increased funds in your bank account to supplement your lower payroll deposits in covering fundamental living expenses.

- After you’ve totally contributed the refund amount, bump your contributions back to their initial levels.

This act might lead to a very high return of 50%, 100%, or other (depending upon your employer’s coordinating funds) –– and it’s a ensured favorable return!

2. Settle Any High-Interest Financial obligation you have, in Order of Highest APR

If # 1 isn’t an option, or you are on speed to get your employer’s optimum 401K and HSA matching anyways, I would next rely on settling high interest debts, in the order of greatest APR to lowest APR. Remember, your tax refund is your money, and that money might have been used to settle financial obligations over the course of the prior year. Because it wasn’t, any unsettled financial obligations were compounded with time. It’s time to reverse that.

Yours might vary, however rate of interest, from greatest to most affordable APR, usually follow this order (by debt type):

- Payday advance

- Charge card

- Home Equity Credit Line (HELOC)/ House Equity Loan

- Trainee loans

- Auto loans

- Home loans

Given, paying off financial obligation is not technically an “investment”, however successfully, it is. The regrettable situations of constructing up debt has caused guaranteed substance interest working versus you, and when you eliminate that debt, you are efficiently getting a ensured favorable return (by partially/fully eliminating future accrued interest).

3. Add to your HSA or IRA

If you’ve already received maximum matching funds in # 1, or debt rate of interest in # 2 are lower than the returns from what I will highlight, the best use of your tax refund will be to contribute much more to your HSA or make an Individual Retirement Account contribution. Choosing which of the 2 is more useful to contribute to is a bit complicated, and I cover it in my HSA contribution deadline post. It basically comes down to what portion Saver’s Tax Credit you may be eligible for on retirement contributions, and how that percentage compares to your individual tax rate ( which comes back to you in the form of tax-free withdrawals from your HSA for medical expenses).

In any case, whether adding funds to your HSA for tax-free medical cost withdrawals, or getting a tax credit for Individual Retirement Account contributions, you’re getting a guaranteed favorable return.

4. Spend Loan on Products that Save you Cash

If # 1 –– # 3 aren’t pertinent to you, then there are ways to get a favorable ROI by buying environmentally-friendly products that conserve you loan. Simply a few of my favorites consist of:

- Nest clever thermostat: the top selling, highest ranked, clever programmable thermostat. Versus a non-programmable thermostat, it might save you $180+ per year.

- Philips A19 LED bulbs: a terrific LED bulb that I personally use that has similar light qualities and appearance to an incandescent, however one-tenth of the energy usage and an expense of simply over $1/each.

- Delta Low Flow Showerhead: provides you an option between a 1.85 gallon-per-minute (gpm) and 2.5 gpm circulation, without feeling like you’re not getting enough water. The 2.5 gpm setting can save a family of 4 $260 annually in heating expenses alone vs. an older 5.5 gpm system. That’s a 640% ROI in one year! Not to mention the big quantity of water cost savings.

These 4 methods will help you turn the negative of getting a tax refund in to a strong positive.

Comments