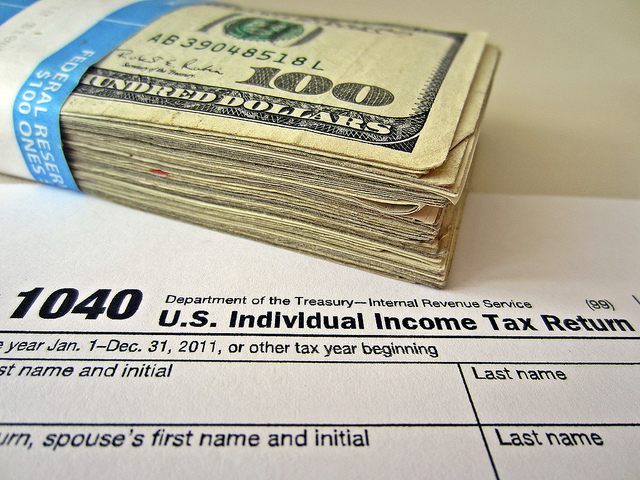

If you belong to the sandwich generation, having a cash management plan is vital.

Everyone knows that raising kids can put a major capture on your budget. Beyond covering daily living expenses, there are all of those bonuses to think about– sports, after-school activities, braces, a first automobile. Oh, and do not ignore college.

Add caring for senior parents to the mix, and stabilizing your financial and family commitments could become much harder.

“It can be an emotional and monetary roller coaster, being pushed and pulled in multiple directions at the very same time,” says monetary life coordinator and author Michael F. Kay.

The “sandwich generation”– which explains people that are raising kids and taking care of aging parents– is growing as Baby Boomers continue to age.

According to the Center for Retirement Research at Boston College, 17 percent of adult children work as caretakers for their parents eventually in their lives. Aside from a time dedication, you may likewise be committing part of your spending plan to caregiving expenditures like food, medications and physician’s appointments.

When you’re captured in the caregiving crunch, you might be questioning: How do I take care of my parents and kids without going broke?

The answer depends on how you approach budgeting and saving. These money strategies for the sandwich generation and budgeting suggestions for the sandwich generation can assist you stabilize your monetary and family top priorities:

Interact with moms and dads

Quentara Costa, a certified monetary planner and creator of financial investment advisory service POWWOW, LLC, functioned as a caretaker for her daddy, who was detected with Alzheimer’s illness, while likewise handling a profession and starting a family. That experience taught her two extremely essential budgeting suggestions for the sandwich generation.

First, interaction is crucial, and a cash method for the sandwich generation is to talk to your parents about what they need in terms of care. “It needs to all begin with a frank discussion and plan, preferably prior to any considerable health crisis,” Costa says.

Second, run the numbers so you have a reasonable understanding of caregiving costs, consisting of just how much moms and dads will cover economically and what you can manage to contribute.

17 percent of adult kids work as caregivers for their parents eventually in their lives.

The Center for Retirement Research Study at Boston College

Involve kids in financial discussions

While you’re talking over expectations with your moms and dads, require time to do the exact same with your kids. Caregiving for your parents might belong to the conversation, but these talks can also be a chance for you and your kids to speak about your family’s bigger monetary photo.

With younger kids, for instance, that might involve discussing how an allowance can be earned and utilized. You could teach kids about cash using a cost savings account and talk about the distinction in between wants and needs. These lessons can help lay a strong cash structure as they as relocation into their tween and teen years when discussions may end up being more intricate.

If your teenager is on the verge of getting their motorist’s license, for example, their expectation may be that you’ll assist them to buy a car and truck or assist with insurance coverage and registration costs. Communicating about who will be adding to these kinds of large costs is a great money method for the sandwich generation.

The same opts for college, which can quickly be among the biggest expenditures for moms and dads and essential when learning how to budget plan for the sandwich generation. If your budget plan as a caretaker can’t likewise accommodate full college tuition, your kids need to know that early to assist with their instructional choices.

Discussing expectations– yours and theirs– can help you determine which schools are within reach economically, what scholarship or grant alternatives might be offered and whether your student has the ability to contribute to their education costs through work-study or a part-time job.

Consider the impact of caregiving on your earnings

When believing about how to spending plan for the sandwich generation, consider that looking after aging parents can straight affect your making potential if you need to cut back on the variety of hours you work. The effect on your income will be more considerable if you are the main caregiver and not leveraging other care alternatives, such as an in-home nurse, senior care facility or assistance from another adult kid.

Costa states taking some time away from work can be difficult if you’re the main breadwinner or if your family is dual-income dependent. Losing some or all of your income, even briefly, could make it challenging to satisfy your everyday expenses.

Comments