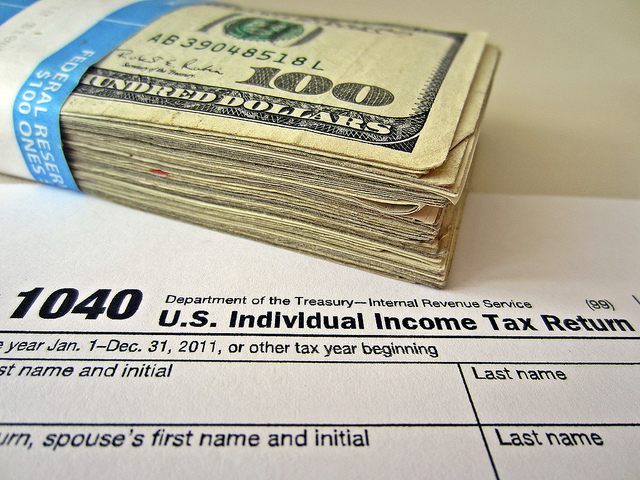

The federal government shutdown is over. Government workers have gone back to their jobs and backpay should be arriving quickly (if it hasn’t already). Things are back to typical … for now.

However, it’s the “in the meantime” part that must leave lots of individuals concerned going forward.

In reality, the last month has been an incredibly valuable moment for finding out for everyone. It’s exposed some hard realities about our federal government, however more than that, it’s also exposed the fragile nature of the monetary and professional lives of lots of, lots of Americans. Numerous thousands of civil servant and much more professionals have actually seen their lives tossed into chaos when they formerly perceived their work as incredibly steady.

This experience has actually supplied everybody with an excellent opportunity to go back and look at the reality of our own financial and professional worlds. It’s pointed at a few things we should all remember as we move forward.

Here are 7 essential personal finance lessons I’ve eliminated from the government shutdown.

1. There Is No Truly ‘Stable’ Job

Part of what captured numerous federal government employees by surprise during the shutdown is the belief that their task was supremely steady which they might rely on that paycheck every two weeks like absolute clockwork. Plainly, that’s not 100% real.

Of course, lots of individuals tend to think in the stability of their job –– numerous state and local government workers and employees of personal services tend to fall into that same frame of mind, even though there’s less evidence of stability there, particularly in the economic sector. I’ve even understood some little business owners who thought that their company was so steady that they might take the earnings for given.

Here’s the reality: No task is perfectly stable. It doesn’t matter who is employing you or what the plan is. Companies can face all sorts of unanticipated problems, even ones as big as the federal government. Unanticipated occasions can take place to any employee, too, changing a stable job into a pink slip at the blink of an eye.

Never ever, ever lull yourself into complacency and believe that the job you have now will always be there and will always be stable. You need to never act as if your next income is an assurance, since even if you have what looks like the most safe task worldwide, it’s not a guarantee.

Rather, you ought to constantly take actions to ensure that your life stays secure even if the next paycheck doesn’t get here. Let’s start with the big one.

2. You Need an Emergency Situation Fund. Period.

This is the first and outright most fundamental action that everybody must take in their individual financing journey. You must have at least a month’s worth of living expenses being in a cost savings account at all times in case of task loss or other emergencies. If you do not have that sitting there waiting on you, you’re pleading to be blindsided during the next big unanticipated event.

Think of it: If every federal worker had a month’s worth of emergency situation savings, the government shutdown would have been much less of a concern in regards to how common people were impacted. Individuals would not have actually been panicking. People might have made reasonable choices regarding their earnings and their future livelihood.

Keep in mind that I’m talking cash here, not credit. Your credit card is not an emergency fund. It will not be there for you throughout a natural disaster. It won’t be there for you if your identity is taken. It won’t be there for you if you have credit issues. Cash is king. Cash fixes issues. Money is safe. Cash is the type you want your emergency situation fund to take.

You need to make it a very high top priority in your life to conserve up a month’s worth of living expenses and stow it away in a savings account. Do it any method you can. My individual suggestion is to set up an automated transfer from your bank account where $20 (or more) is moved each week from inspecting to savings instantly. Then, supplement that with whatever you can until your savings account has at least a month’s worth of living costs in it … but never ever switch off the automated transfer. Leave it there, so that the fund immediately fills and when you tap it, you’re not rushing to refill it.

If you’re wondering how in the world you could perhaps conserve up a month’s worth of living expenses, keep reading.

3. If You Can’t Do This, You’re Living Far Beyond Your Method

This is the plain truth that many individuals do not desire to become aware of their finances, but it holds true: If you can’t conserve up for an emergency situation fund in any sort of affordable amount of time and you can’t make any progress on your debts beyond minimum payments, you are living far beyond your methods. You are constructing a house of cards that will eventually collapse, and when it does, it will injure.

If you take a look around your life and think that it is “impossible” to spend less than you earn, that it’s “impossible” to develop an emergency fund, that it’s “difficult” to pay for your debts in any affordable timeframe, the tough reality is that you’re living beyond your ways. If you ever want anything to be various in your life, you have to change something significant about either your earnings or your spending. If you don’t wish to eventually suffer a financial disaster, you need to alter something significant about either your income or your spending –– or both.

Much of the rest of the short article focuses on profession steps, however right here and now, we’re going to speak about spending. If you struggle to make ends satisfy, you have to alter something about your spending. You require to cut back considerably on the unimportant costs, implying things that don’t include one of the most standard of food, shelter, clothes, and transport to work. All of the extra stuff might feel essential, however it’s setting you up for catastrophe.

There are basically two ways to make a serious distinction in your spending. You can either modify the small, regularly repeated expenditures, in which a modification that conserves $0.10 or $0.25 or $0.50 or $1 can add up to a lot throughout a year, or you can make a significant relocation that in a single action conserves hundreds.

Small relocations (that save a little at a time however develop through repeating) include simply eating all of your meals in the house unless there’s a strong factor to do so (and planning those meals out beforehand so you can purchase groceries with a list), doing energy enhancements to your house like air-sealing the windows and setting up weatherstrips, installing LED bulbs in each socket where you don’t have one, making your own household products like laundry detergent, buying store brand name whatever, and so on.

Big moves (that you can do when or possibly twice however save a lot each time) consist of transferring to a less costly location, looking around for much better automobile and homeowners insurance coverage, eliminating an automobile and depending on public transportation, looking around for a better cellular phone plan, cutting cable and relying just on Netflix and over the air signals, and so on.

If you remain in a situation where something as basic as paying for your charge card or developing up an emergency fund will take years, you need to begin making modifications in your spending otherwise you are asking to be blindsided hard by any sort of uncertainty in your life, and as we’ve developed, no task is totally secure.

Do not let your life be as fragile as a home of cards. Get your costs under control, spend less than you earn, and begin restoring that ship now. Build up an emergency fund, start whacking that financial obligation (starting with the high interest things), and start saving for retirement, too, especially if your employer matches your contributions. If you can’t afford to do that, you’re standing on an extremely high ladder on a really gusty day.

Let’s relocation on to some career guidance.

4. Don’t Think About Your Present Job as Permanent; Instead, Think Big (and Little)

As we’ve developed, there is no such thing as a genuinely stable task, so stop considering your task as an irreversible state of affairs. It’s not.

Rather, think of your current task as a temporary but mutually helpful arrangement that will continue till it’s not mutually useful any more. When your work ceases to be useful to you –– meaning you could make more loan elsewhere or remain in a more pleasurable situation somewhere else or you could retire –– you’ll stop. The same is real for the employer –– if your efficiency isn’t up to snuff or they can’t manage to continue your position, they’ll downsize you.

With that mindset, begin considering what your perfect expert circumstance would be. Would it include more income? Would it include more significant work? Would it include less stressful work? Would it include less personal interruption? It might even include a different area or a different field completely.

You might consider your present job as something pretty near that –– I know I do. In that situation, you need to work to ensure that your present position is as irreversible as you can make it. You wish to fortify your current position and make yourself as valuable as possible.

If your current task isn’t anything near to that, you should work to make sure that you’re getting all set for that next job or your profession switch or whatever the next step is. Do not feel bad about using your present task as a springboard to your next career. If you’re doing your present job however your focus is on conserving loan and getting ready for a profession modification, that’s great as long as you’re fulfilling expectations.

In both cases, a lot of the same principles apply. You ought to have your monetary bases well covered, with an emergency fund and a routine of spending less than you earn, for starters.

Beyond that, there are three things you must always have on your mind at work.

5. There Is Immense Value in Having a Strong Expert Network, So Start Cultivating One

You require to have as numerous strong professional relationships in your field as you can cultivate, both inside your own workplace and beyond it. The more relationships you have, the most likely it will be that you can tap one to make the next step in your profession, whether it’s a step you take by your own choice or a step forced on you by an unsteady company.

The first thing you can do is be a reliable colleague that your fellow employees can depend upon. Few things trigger poison in the work environment than someone who is not doing their part and can’t be counted on. Do your job to the very best of your ability and attempt to avoid letting others down. If you have to let somebody else down, be very clear with them on what you can’t take on, with as much notice as possible.

You should prevent unfavorable discuss coworkers and others in your field whenever possible. While this might help you cultivate a really small network of strength, it burns a great deal of bridges and damages your credibility. It’s impossible to cultivate a strong network if you’ve burnt a lot of bridges and people don’t trust you.

Take every opportunity you can to go to conferences, conferences, and conventions related to your field. Meet great deals of people, then take the time to follow up with many of the people you meet with additional contact in the future. Gather a lot of contact information and company cards and follow up with all of them.

Touch base with individuals in your workplace regularly and the people in your professional network routinely. Attempt to avoid consuming lunch alone. Know a thing or more about everyone and utilize that as a source of conversation. If you find that any of those people need assistance, particularly if it’s the type of assistance you can use with relatively little effort compared to the benefit to that other individual, do it without concern and without wondering what you get in return.

If you do this regularly when things are excellent and steady, you’re going to discover that when you have a professional need, there will be a lot of people able to assist and a great deal of unexpected doors available to you. Hence, these efforts ought to be a constant part of your expert life.

6. You Ought To Constantly Watch on Improving Your Own Marketability and Transferable Skills

Another vital part of your expert stability is your capability. Not just do you need to have the skills necessary to do your job as it sits right now, you also should be cultivating the skills needed to do the next job you desire to do and the skills you’ll need for your current job in the future.

There are lots of methods to tackle this, and they differ extensively. Some professions depend on self-education. Others depend on accreditations. Still others rely on on-the-job learning. Whatever it takes, you need to be dedicating some of your time to adding new skills to your collection related to the profession course you see yourself following going forward.

One great way of doing this is by taking a look at what skills are needed and what abilities are desired for the job that you want to have. Go look at task listings for the job you wish to have and after that use that as a list for the abilities you need to be cultivating.

Another approach is to take a seat with your supervisor and discuss a strategy for you that will cause a raise or a promotion. Often, the abilities cultivated throughout that process are ones that improve your worth in the expert marketplace too, plus it strengthens your relationship with your manager as you’re moving through the steps.

Of course, you need to promote this fresh marketability …

7. Your Resume Should Constantly Be All Set to Go

Make sure that your resume is prepared to send out at all times. Review it monthly, if not more typically, and keep all of your skills up to date there.

You should, at the minimum, keep a resume that’s prepared to mail in a document on your computer or in the cloud (I utilize a Google Doc), in addition to upgrading your resume in a couple of places that can quickly be discovered online, such as LinkedIn. An upgraded resume that you have in hand makes it simple to quickly send one off if needed, and having actually an upgraded resume online makes it simple for others to discover you with possible offers and allows others to share your resume in your place, something that takes place in some cases when you have a strong professional network.

You should actually pencil this in as a month-to-month reminder or to-do. The time it requires to make sure that your resume document is upgraded and in an easy to find location plus the time it requires to upgrade your resume at sites like LinkedIn is very little; you can do it in simply a few minutes.

Yet it’s that regular updating that keeps the window open for chances to come in. People will discover your resume online and may contact you with offers. Expert associates may recommend your resume to others for potential job deals or other chances. Keep it updated and those doors stay open for you.

Final Words

The key lesson of the federal government shutdown is that no job is irreversible. No matter how trusted or trustworthy your company appears to be or how incredibly you carry out at your job, things can constantly take place. You can be a worker of the federal government, which is about as stable as you can get, and still be a month late in receiving your pay. Pink slips can take place. Unexpected business insolvencies can take place.

Things take place. Be all set. If you’re not, another person will be.

Best of luck.

Comments